The trading during the differ parts of the year could be much differ. If you trade by one way in August, you have to change that way in September. We will show in our lessons how to trade during the year.

Many traders do not want to trade in August, because then is very difficult to trade. Then in August as a holiday month in the north Globe the top dealers and many of the top dealers in the banks have a rest. They do not trade then and on the market have little volumes and strange movements not combine with the picture by the technical indicators.

There are couple of ways to trade during the year.

- Strategy 1: Using the trend

- Strategy 2: Using MACD trend

- Strategy 3: Using MACD signals

- Strategy 4: Using Stochastic indicator only

- Strategy 5: Using Stochastic indicator and MACD

- Strategy 6: Using Fibonacci levels

- Strategy 7: Using the chart figures

Strategy 1: Using the trend

The trading using the trend is the simple trading way. “The trend is your friend” are told many dealers. What the trend mean? The trend is the direction where the trading with some currency pair will go on.

You simple are watching where is the direction and buy or sell where the trading goes on. But it is not so simple. You have to have sure proofs that the trading is go with the trend and for the future.

The market has to be moving on with some news, some basic news which is made the trend trading. It could be economic indicator announced in short time before, some major event happen worldwide or some speech of some main people like finance minister, some chief of ECB, Fed Reserve or other.

But also the trend trading could be cause and by some rumors appeared among the traders. You has to be sure that the market is moving by some event, event that is caused the trend on the market. Without event sudden trend is not a guaranty for continues such trend.

You could catch up the trend and when come in positions to turn the trend or to finish with the trend. Then to define well if it is trend is better to use the technical indicators. There are many indicators, as if you follow each of them you will confuse totally.

So it is use only few technical indicators, which make sure trading. One of the indicators has just showed the trend. This is ADX technical indicator. It is one of not much using and not so good indicator. The indicator consists of three lines. You can see the details for the indicator in the previous lessons. The ADX line shows how strength is the trend.

How the ADX line is upward and continue to be upward it mean that we have a trend at the moment. In the chart below is shown how to define the trend using ADX technical indicator. But ADX indicator as all is not so useful and you could not define well the trend using ADX.

To recognize when the market trading using the trend is better to use MACD. MACD is the indicator using in all trading ways and without MACD is a trading like the driving in the thick fog.

ADX trend

It is almost not possible to define the trend without to draw over the chart. It is taken the trend line and chart to define if have some trend. On the chart below is shown how the trend line defines the levels within the trend. So any significant movement out of the trend lines mean end of this trend.

To use this trend and to guaranty enough movement when you entry the market is better to use this trend for bigger chart period more than 1-hour. For the long traders it is better to use charts more than 4-hours. But it is possible to use and for shot periods too, as on the chart below. With 1 on the chart below is showing the start of the trend and with 2 is show when the trend is over. But to appoint it better is necessary to use an MACD indicator, which in the next trading way we use it.

Strategy 2: Using MACD trend

This trading is one of the most difficult to define. But this trading is also starting by some major event like economic data public before with significant difference by the expectations, speeches or rumors on the bourse.

First of all using MACD to define if it is trading with the trend is to use MACD for long time period charts. Suitable for the trend recognize trading is for charts more than 1-hour.

Usually it is using 1-hour charts, 4-hours charts, 6-hour charts and 1-day charts. For 1-day charts it is good to use for long traders, who trade positions for more than one week, usually from 2 weeks to 3-4 months.

Such trading for long traders is needed to use less margin than the standard using by most trading companies of 1:100. It is better to use margin like 1:10 – 1:25 and to use stop losses more than 250 pips.

For the short traders prefer daily traders is better to use 1-hour chart trend and they could use margin to 1:100 maximum with stop losses about 40 – 80 pips. When is define the MACD trend is better to use the maximum fast of the trend. It means if the MACD chart fast move upward or downward we have sure signs for good trend. The slowly and slanting movement of MACD did not mean trend.

It means that at any moment the movement in the current direction could stop and to start movement in the other direction or that with the current trend is over. On the 1 day chart below using MACD is shown how strong is the trend and are shown two moments (1,2 - Entry 1, Entry 2)where are define good entry levels for a sure trend continue further. The Exit is recognized on the MACD indicators as 3.

Strategy 3: Using MACD signals

This way of trading is one of the best and most successive trading ways. MACD is such indicator who uses more than 75 % of the traders. MACD give excellent signals when the both MACD line crosses that every trader make action on the market by the crossing.

The upward crossing above the zero line generates a sell signal. The power of the signal means by the level at which MACD cross.

The signal could cross at level of MACD at 0.0001 and it could be at levels above 0.02. So for better explaining of the markets movements are better to use MACD at level above 0.0005.

When MACD lines are crossing between below zero line it is a buy signal. The power of the signal also means by the level, which the lines cross. It also could be told that the power of the signal is so much power than the line crosses how far is possible by the zero line.

Also for generating of buy signal is better to use MACD cross at levels lower than 0.0005.

Some traders use the crossing of the zero line as signal. This case is possible to use when the trading is in short range and the MACD is within the zone of –0.0005 and +0.0005. At this crossing have extra stimulus to continue the trading in the trend starting by the last crossing of both MACD lines.

One of the most successive scenarios to have sure positions using MACD indicator is to entry the market when the crossing is after smooth moving of the main MACD EMA. Then after smooth moving and making smooth top of MACD EMA the crossing SMA line is with downward or in horizontal movement and is seeing the turning start for sell and when SMA crossing below zero MACD line have upward start or horizontal starting upward movement.

But to see what will happen further is better to use longer charts. For example if you trade at 15 minutes charts is better to check what will happen after the crossing of MACD lines using 30 minutes or 1-hour chart with MACD.

On the chart below the MACD show one moment to sell with 1 when MACD lines crosses and with 2 the exit moment.

In this trading using only one chart for example the 5-minutes chart is better to protect stop losses with average 25/35 pips and to expect 25/40 pips profit. How the chart period is higher so bigger profits could expects.

For 1-hour chart is better to use stop losses at 30/40 pips and take profit average of 60 to180 pips.

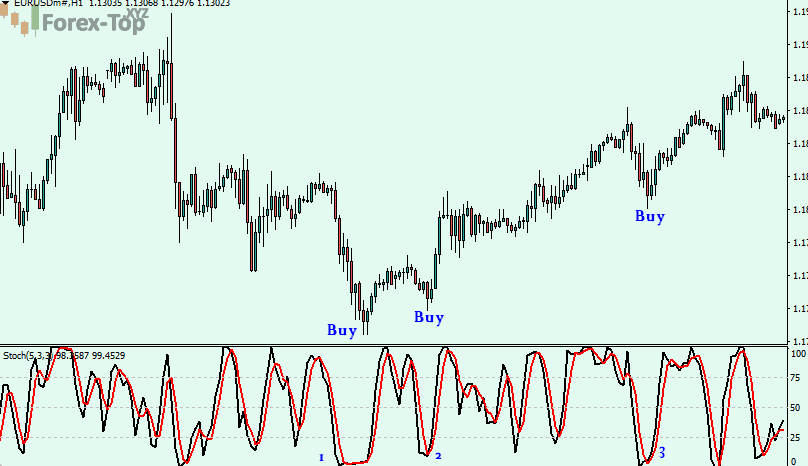

Strategy 4: Using Stochastic indicator only

The second big part of the traders use Stochastic indicator only for the trading. The indicator has appointed levels from 0 to 100. The indicators both line the clear line and the dash line when crosses between at levels below 25 and level higher than 75 they generate signal.

The buy signal come when the main stochastic oscillator line and the dash line crosses at level below 25. The sell signals come when the lines cross over 75.

Not any cross but generate signal. The clear signal come when the lines and especially the %K line is smooth. When the line %K is at waves with not regular form it means than the trading level is moving faster and is not appropriate to entry the market.

This is very important! When the %K line makes waves it is sure sign that the crossing of the lines DO NOT generate signal (1 on the figure). This is sign for continued trend in the same direction and the signal will come only when the line stay smooth. At (2 on the figure) is generating signal, as then the chart is smooth and supported by MACD.

See the example below on the chart.

With stochastic oscillator is one very good indicator for the help to determine exact the market changing trends. Sometime the trading could be based over this indicator almost all the time. In June and July 2003 the trading were based over stochastic oscillator. With stochastic is possible to make very good profit.

One of the main elements where the traders could find that the trend of MACD signal is over is to see Stochastic Oscillator.

The standard Stochastic signal in on the chart below. There the lines are smooth and the signals are clear and sure.

With 1 on the chart below is show the smooth Stochastic Oscillator crossing of the lines giving a sure buy signal.

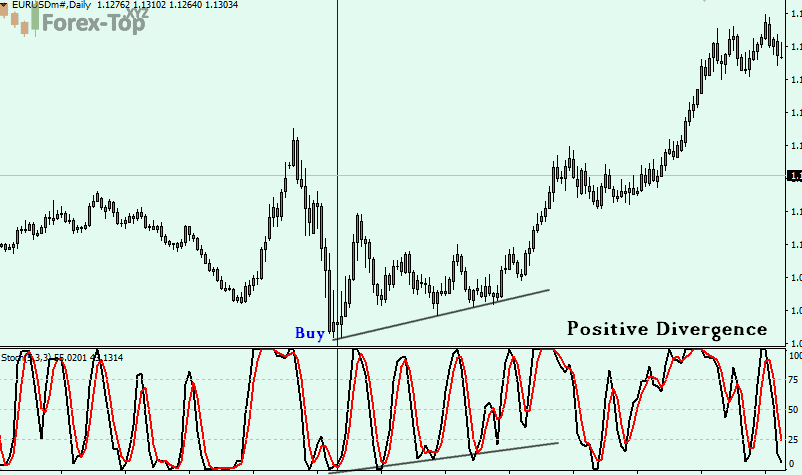

One of the surer signal using stochastic oscillators comes when is forming double top or double bottom with divergence.

If you are not bought or sold at the first crossing of the both lines at levels below 25 and over 75 and latter became second top which is with less power like on the chart below it is sure signal for big movement.

The figure below with 1 is shown the positive divergence where is sure buy signal.

With 2 on the chart below is shown the sell signal generate by negative divergence.

Strategy 5: Using Stochastic indicator and MACD

The using of both technical indicators is the key to the success. Over 90% of the traders use at least one of both indicators. Using and both indicators together thekey for the success is open.

Both indicator together could show with the highest precise the movement on the market. The indicators together make the trading much easy and with detail analyses every trader could explain the short movements on the chart.

The 90% of the traders use at least one of both indicator, also about 90% of the traders use technical indicators to make the trading on the forex market. One key advice to every trader starting on the forex market is to not go to trade without to watching at least one of both indicators!

What just could make more on the market using both indicators together?

First of all both indicators in combination will show where the starting trend

forming by MACD crossing of both lines finish. On the chart below is show where

Stochastic oscillator show the end of MACD starting trend. There all is finished and is

better to close the open positions if is using MACD analyses only. But if is using

MACD and stochastic analyses together such entry could not make. See on the chart

at 1 is giving the signal to buy using MACD, but stochastic oscillator latter show sell

and 2, so it is a sign for exit analyzing the second help indicator. If you use MACD

the exit level will be at 3, as that will make some losses if you wait to see MACD exit

signal.

Using MACD and stochastic oscillator is possible to make especially using stochastic many trading for 15 minutes chart it is possible to make at least 25 trading for 24 hours.

But it is not successive, the success come by the big trends and by longer chart analyses.

The best way to make this trading using MACD and Stochastic is to make the follow. It is necessary expect such levels of both indicators, where are showing movements in one direction.

There for very short time is receiving strong movement on the market and movement are much more sure than the moving using by only one indicator.

Strategy 6: Using Fibonacci levels

Many Traders use Fibonacci to determine where are the support and resistance levels.

Fibonacci mathematic calculations are one of the most power mathematic analyses on the forex charts where the traders could appoint with big accuracy the support and resistance levels.

The using of Fibonacci is simple and is necessary to find a good top and bottom on the chart to place Fibonacci levels between. The levels between the top 100% and the bottom 0 % are the zones where is expecting the trading to meet resistance. The levels are the follow:

- Level 1 – 23.6%

- Level 2 – 38.2%

- Level 3 – 50.0%

- Level 4 – 61.8%

- Level 5 – 100.0%

The Fibonacci levels also include resistance and above 100% and the levels are:

- Level 6 - 161.8%

- Level 7 – 261.8%

- Level 8 - 423.6%

The levels 6,7,8 are not using much by the traders and there is expecting minor resistance.

The using of Fibonacci is better to be using for bigger charts 1-hour, 4-hours, 6-hours 1-day charts. It is appropriate to use and for little periods, as few days but the top and bottom have to be very good determined.

By the same way is using to determine the support levels, as instead to using top and bottom is using bottom and top. The procedure is the follow:

It is take good determine bottom and top. Place Fibonacci between the bottom and top. The first supports come again at 23.6% followed by 38.2% and so on.

The key element for Fibonacci and to be sure in the using of Fibonacci when two Fibonacci levels by two difference top and bottoms (bottom and tops) will have same levels of resistance (support).

The levels could not be the same but the lines have to show the same currency levels. For example resistance for longer period Fibonacci level of 38.2% comes for EUR/USD 1.1525.

For short period 61.8% Fibonacci resistance is also at 1.1525. It means that the levels are good determined and the power of the resistance will be stronger.

At the levels of 23.6% to 100.00% if have not exact and view support (resistance) then the levels of Fibonacci are not using.

They are false and is better to not use Fibonacci for the moment or to find new other two top and bottoms where placing the Fibonacci levels on the chart will determine easy that the normal moving trend on the market is broken and the trading event is pushing away by the levels.

As one of the key levels for the market charts is possible to determine as levels 61.8%, 100.0%, 0% and 38.2%. These levels are the strongest but are better to consider for stronger the combination of two Fibonacci levels determine by difference top and bottoms (bottoms and tops).

On the chart below is showing how to determine the Fibonacci levels using top and bottom. There is seeing easy that the levels 38.2% make support. The support at 23.6 % with sign 1 is overtaken fast, but at 2 the support at 38.2% is sure and the trading do not overtaken that support. For the chart the Top to the Bottom places using Fibonacci.

Strategy 7: Using the chart figures

The charts and the figures on the charts talk to the traders much more than any technical indicator. Double top, head and shoulders, waves and much more are one of the best signals for the market traders.

On the figures below are show the main and most important figures that are surer to make winning strategy on the market.

1. The Backtrack – After every big moving in one direction follow backtrack. The market up or down usually retrace a significant portion of the previous trend. That correction is measure in percentages. The most common is fifty percent retracement of the previous trend. Maximum the retracement is two thirds and minimal one third.

2. The Trend Line – Draw always trend line. It is simple and effective way to catch up the market movement. It is using the trend lines placing between two upward or downward tops. If the trading brake the trend line it is expect to start new trend. Otherwise trade in the trend line. With 2 on the chart is shown the end of the trend line.

3. Calming waves. This element on the chart is possible to find after strong movement after that follow the calming waves and in one moment the waves stay with too short range. Any movement out of the drawing lines follow new strong movement in one or another direction. On the chart below there two buy signals the first come when the market touch the trend line and the second when the market trading broken the trend line.

4. Head and Shoulder. On the charts is possible to see one big top (or bottom) with little top (or bottom) next. The second top (or bottom) is s signal for movements in downward direction (upward direction). On the chart with 1 is show the first big topand 2 are the second top the shoulder. Second top is a sign for downward movement and the key sell level come when is broken the key support line.

The chart figures trading is one of the surest trading way and most successive. To be using right it is necessary to use for bigger chart periods. The figures but come rarely on the charts and is necessary to be patient when recognize the figure on the chart.

.png)